Accounting Services

Accounting Overview Training

Revised April 24, 2014

Purpose

To provide University Business Managers and Financial Administrators with:

- A basic understanding of the authoritative bodies that set rules for Higher Education, State and Local Government accounting;

- A basic understanding of the University’s accounting system; and,

- A basic understanding of the principles used to charge costs to institutional activities.

Accounting Rule Setting Bodies for Higher Education, State and Local Governments

Governmental Accounting Standards Board (GASB)

- Created in 1984

- Overhauled Accounting Rules for State and Local Governments in 1999

- GASB Statement No. 34 – “Basic Financial Statements and Management’s Discussion and Analysis for State and Local Governments”

- GASB Statement No. 35 – “Basic Financial Statements and Management Discussion and Analysis for Public Colleges and Universities”

- New standards have moved governmental accounting to more closely resemble corporate accounting

- Changes driven by Wall Street investors

Louisiana Office of Statewide Reporting and Accounting Policy (OSRAP)

- Issues guidance on State of Louisiana interpretations of GASB pronouncements

- Sets policies for general accounting matters such as requiring all checks to be deposited within 24 hours of receipt

American Institute of Certified Public Accountants (AICPA)

- The AICPA issues Statements of Auditing Standards (SAS) which set the standards for conducting financial audits and sets the criteria for reportable conditions such as audit findings.

United States Government Accountability Office (GAO)

- The GAO issues Generally Accepted Governmental Auditing Standards (commonly referred to as the Yellow Book) which set the standards for which financial audits of state and local governments are to be conducted and sets the criteria for reportable conditions such as audit findings.

- In recent years, the GAO and the AICPA have been working collectively to ensure consistency between Statements of Auditing Standards and the Yellow Book.

United States Office of Management and Budget (OMB)

- OMB issues circulars that provide authoritative financial and administrative guidance

- OMB Circular A-21 - “Principles For Determining Costs Applicable To Grants, Contracts, And Other Agreements With Educational Institutions”

- OMB Circular A-110 - “Uniform Administrative Requirements for Grants and Agreements With Institutions of Higher Education, Hospitals, and Other Non-Profit Organizations”

- OMB Circular A-133 – “Audits of States, Local Governments, and Non-Profit Organizations”

National Association of College and University Business Officers (NACUBO)

- Issues guidance on GASB pronouncements that are specific to Higher Education

LSUHSC-NO Accounting System Overview

LSUHSC uses the PeopleSoft Financials system.

PeopleSoft uses Chartfields which are data attributes that are used to classify transactions and account balances.

The primary Chartfields used by LSUHSC-NO are:

- Account

- Fund

- Department

- Class

- Program

- Project

Account - a label used for recording and reporting in units of money, assets owned, liabilities owed, and transactions or other economic events that result in changes to assets and liabilities (i.e. revenues and expenses). Accounts are the building blocks of all accounting systems. LSUHSC-NO’s account structure is a follows:

- Assets – accounts between 100000 and 199999

- Liabilities – accounts between 200000 and 299999

- Net Asset (Fund) Balance – accounts between 300000 and 399999

- Revenues – accounts between 400000 and 499999

- Expenses - accounts between 500000 and 599999

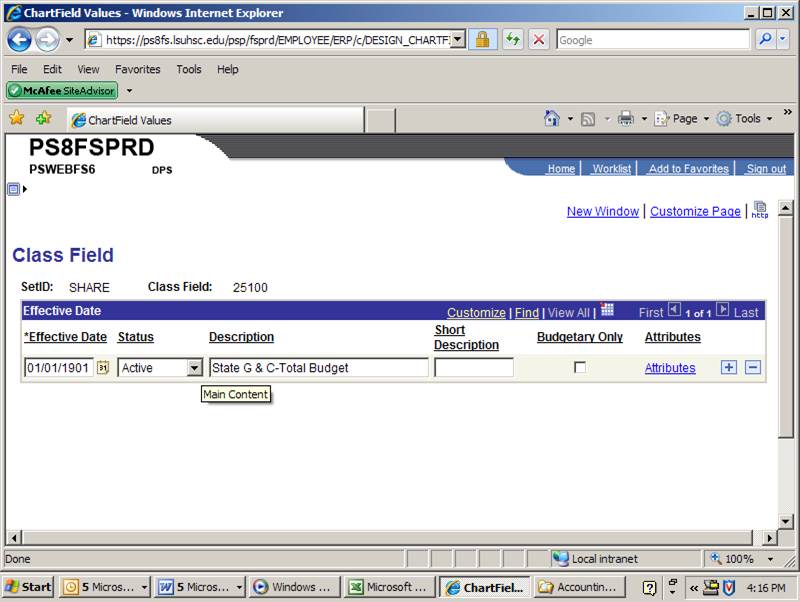

Class – the class code is used to define the source of funds (i.e. State Appropriation, Federal Grants and Contracts, State Grants Contracts, etc.). Some of the more common class codes are:

- 10105 State Appropriation & Self generated funds

- 10205 State Interagency Transfers

- 20200 Federal Grants and Contracts

- 25200 State Grants and Contracts

- 35200 Private Grants and Contracts

PeopleSoft Class Code Screen

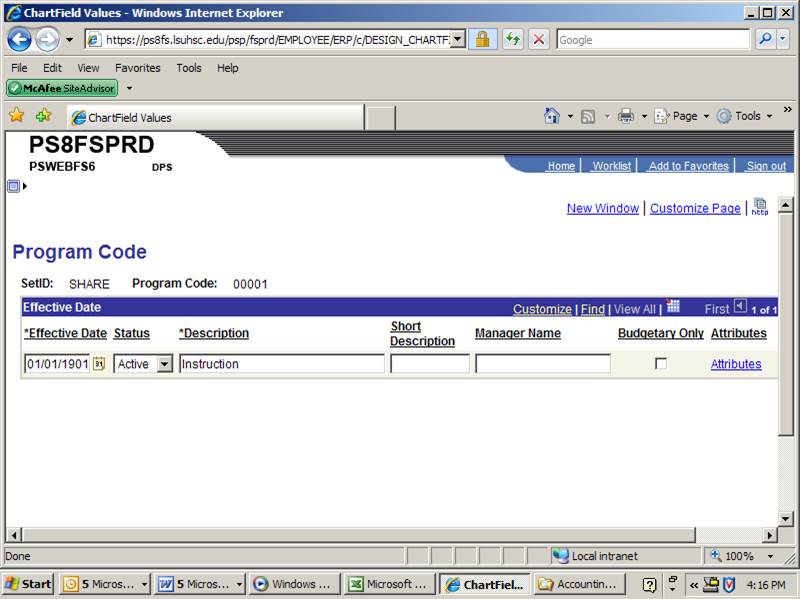

Program – program code is used to classify how funds are used (i.e. Instruction, Research, Public Service, etc.). Some of the more common program codes include:

- 00001 Instruction

- 10001 Research

- 20001 Public Service

- 30001 Academic Support

- 40001 Student Services

- 50001 Institutional Support

- 60001 Operation and Maintenance of Plant

- 70001 Scholarships

PeopleSoft Program Code Screen

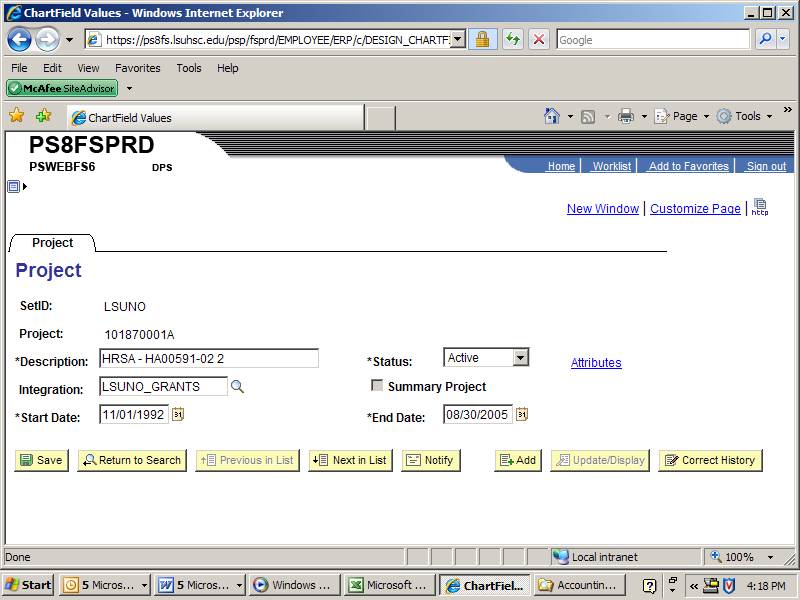

Project/Grant - a 10 character code used to group related revenues and expenses together such as a grant, contract or similar cost objective.

- Interagency Transfer projects begin with the number 4

- Sponsored Projects (i.e. Grants and Contracts) begin with the number 1

- Other current restricted fund non-sponsored projects begin with the number 5

PeopleSoft Project/Grant Screen

LSU Account Numbers (Legacy Account Numbers

LSUHSC-NO’s previous accounting system which last processed transactions in July 2001, contained a data element named “LSU Account.” LSU Account numbers were created for reference purposes from July 2001 to June 2009. The data captured in this field is not consistent with the definition of the term “account” that is contained in Generally Accepted Accounting Principles issued by GASB or the Generally Accepted Governmental Auditing Standards issued by the GAO. Care should be taken when using this term so that there are no confusions with the generally accepted accounting definition of the term “account.” For example, we want to avoid a customer or an auditor believing that we are referring to a bank account or an expense account when we are actually referring to a project or an unrestricted budget.

Reporting Cycle and Basis of Accounting

LSUHSC-NO is required to close the last month of each fiscal year (June) using the full accrual basis of accounting. Under the full accrual basis of accounting, revenues are recognized when they are earned and expenses are recognized when they are incurred. The earnings process is generally defined by the performance of services required to earn the revenue. The incurrence of expense is generally determined when goods are received or when services are performed.

The other eleven months of the year, LSUHSC-NO is on a “record what can be recorded” methodology.

- Payroll and the associated liabilities are generally recorded in the period in which the payroll checks are issued.

- Accounts payable transactions are generally recorded in the period in which the vendor invoice is paid.

- Billing and Accounts Receivable transactions are generally recorded in the period in which the invoice is issued

Accrual Accounting vs. Cash Basis Accounting

- Timing of cash flows does not impact revenue or expense recognition.

- Revenues are recognized when services are performed, Cash receipts are recorded when cash is received. These events normally occur at different times.

- Expenses are recognized when the expense is incurred. Cash disbursements are recorded when cash is disbursed. These events normally occur at different times.

The General Ledger is used to record monetary transactions of the University in the form of debits and credits. These transactions can be directly entered by journal entry or they can be interfaced from systems such as the Human Resource Management System, Accounts Payable, Billing and other systems. The General Ledger is considered the official books and records of the University and it is the basis of financial statement preparation and audits of the financial statements.

The General Ledger should be used as the basis for reporting and any financial information maintained outside of the General Ledger (i.e. “Shadow Systems”) should be reconciled to the General Ledger to ensure compliance with OMB A-110.

Special Accounting Topics

Fringe Benefit Accounting

The University has elected the fringe benefit rate methodology defined in OMB Circular A-21. This methodology calls for the University to estimate fringe benefit expenses and submit a proposal to the US Department of Health and Human Services (DHHS) six months prior to the start of the fiscal year. Once this rate is approved by DHHS, it is consistently applied to grants, contracts and other institutional activities.

Grant and Contract Management and Transaction Review

The review of grants and contracts should place special emphasis on the difference between current year revenues and current year expenses. This difference may indicate unexecuted contracts, unbilled executed contracts and inappropriately charged costs. The main scope of the legislative audit is current year revenues and expenses.

Cost Accounting

OMB Circular A21 (Principles For Determining Costs Applicable To Grants, Contracts, And Other Agreements With Educational Institutions) establishes the criteria for charging costs to grants, contracts, and other institutional activities. OMB A-21 is a federal law (2 CFR 220).

OMB A-21 Key Points

- Defines Direct Costs and Indirect Costs.

- Provides Specific Guidance on 54 Items of Cost.

- Defines methods for charging fringe benefit.

- Defines the methodology for computing indirect cost rates.

- Requires a disclosure statement of cost accounting practices for all organizations receiving $25 million in federal assistance

OMB A-21 Section D.1 - Direct Costs

Direct costs are those costs that can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity, or that can be directly assigned to such activities relatively easily with a high degree of accuracy. Costs incurred for the same purpose in like circumstances must be treated consistently.

Examples of Direct Costs:

- Salaries and fringe benefits of faculty, technical staff, and research assistants

- Travel

- Laboratory supplies

- Animals and animal care

OMB A-21 Section E - F & A Costs

Facility and Administrative (F&A) Costs - “Costs that are incurred for common or joint objectives and therefore cannot be identified readily and specifically with a particular sponsored project.” (OMB A-21, section E.1.)

Examples of F&A Costs:

- Salaries of administrative and clerical staff

- Office supplies

- Postage

- Local telephone calls and line charges

- Memberships

- General use computers

OMB A-21 Section J - General Provisions for Selected Items of Cost

- Provides principles to be applied in establishing the allowability of certain items as direct or indirect costs.

- Section J.10 (2) – Payroll distribution system must reasonably reflect the activity for which the employee is compensated by the institution

- J.29 – Any excess of costs over income under any other sponsored agreement or contract of any nature is unallowable.

- Time and Effort Certification (Effort Reporting) encompasses many processes, including committing effort, charging and cost sharing salary expenses for effort, and certifying effort to support commitments and salary charges.

- LSUHSC-NO must assure Federal funding agencies that the assignment of time and associated salary are appropriately expended to sponsored agreement(s). These expenditures must be fair, timely, and consistent with the effort expended on the sponsored project.

- LSUHSC-NO uses After-the-Fact Effort Reporting as the means to fulfill the reporting requirement stated in 2 CFR 220 (formerly OMB Circular A-21, J10).

- Effort is not just a rubber stamp of the salary or payroll distribution. Each time an effort certification form is filled out it must be carefully examined and any substantive errors reported to the department for correction in a timely fashion (within 45 calendar days).

- The time and effort certification form is merely one opportunity to make corrections. Anytime there is a substantive variance in the effort allocated to an activity, it should be reported to the department for adjustment.

- Any person whose personnel costs (or portion of their personnel costs) are allocated to a sponsored project must certify that the costs are reasonable in relation to the effort expended on the project.

- Effort must be certified by a person who has a “first-hand knowledge” that the effort was expended as documented.

- Faculty, academic staff, and all PI’s should certify their own effort.

- Graduate students, postdocs, and non-PI classified staff members who work on a PI’s project should certify their own effort. However, the PI can certify if needed.

- Any adjustments required as a result of the review and verification of the time and effort certification form will require a cost transfer.

- Cost transfers must be performed in accordance with the University’s Cost Transfer Policy. This policy applies to federal, state and private awards.

DS-2 Overview

- Required for any institution with $ 25 million or more in federal assistance.

- LSUHSC-NO reported $ 68 million in federal assistance in FY 2009.

- Discloses the University’s cost accounting processes, including processes for determining direct costs of sponsored agreements and process for calculating Facility and Administrative Cost Rates.

DS-2 Section 2.1.0

Criteria for Determining How Costs are Charged to Federally Sponsored Agreements or Similar Cost Objectives

LSUHSC-NO follows the general guidelines in sections D and E of OMB Circular A-21 in determining the treatment of costs.

DS-2 Section 2.5

Method of Charging Salaries and Wages

Salaries and fringe benefits of faculty, professional staff (e.g. research associates), technicians, lab assistants, and graduate students associated with effort on research projects, instructional activities and other direct cost objectives are treated as direct costs.

Salary and Wage Cost Accumulation System

- A PER-2 is used to document the appointment of an individual to an authorized position.

- A PER-3 is used whenever some change occurs to record the salary level and the expected distribution of salary payments between accounts.

- Time and Effort reports will be sent to all faculty/professional every six months, except for those exclusions identified in 2.5.1.

- These forms (time and effort reports) are used as LSUHSC-NO’s compliance with After-the-Fact effort distribution certifications.

- These forms are signed by the individual, the principle investigator or another individual with first hand knowledge.

- If retroactive changes are needed then the department will route a PER-3 to correct the distributions.

Additional Comments

General Rule of Thumb - Costs of faculty effort should be charged to where it is expended. The concept of paying an employee from a source of funds is not supported by OMB A-21 or the DS-2. “Spending down” a terminated sponsored project surplus balance by inappropriately classifying costs is a violation of the DS-2 and OMB A-21. Instead close out the terminated project in accordance with the Grant and Contract Closeout Policy.

Key Activities

- Preparation and Approval of Personnel Appointment Forms (PER-2) – This is the activity where the initial distribution of salary cost is determined and set up in the HR system.

- Preparation and Approval of Personnel Status Change Forms (PER-3) – This is the activity that is the basis for the processing of changes to the initial distribution of salary costs.

- Monthly Review of Grant and Contract Project Balances – This is the process where revenues are compared against expenses and any unusual or unexpected surpluses or deficits are investigated and any necessary corrective actions initiated

Consequences of Non-Compliance

- DHHS-OIG Audit Findings

- Legislative Audit Findings

- Internal Audit Findings

- Internal Compliance Audit Findings

Accounting Services Website

- Disclosure Statement (DS-2)

- F&A and Fringe Rates

- Other Resources (OMB Circulars, NCURA, COGR and others)

- Policies and Procedures

Getting Help

If you have any questions, please contact Accounting Services by:

- Phone: 504-568-4815

- In Person: RCB, 6th floor

- Website