Office of Sponsored Projects

Time and Effort Certification

Revised May 1, 2014

Purpose

The purpose of this training course is to familiarize faculty and administrative staff with the University's effort reporting process, in order to comply with Federal regulations and LSUHSC-NO policies and procedures that govern effort on sponsored projects/agreements.

Audience

All individuals involved with the administration and conduct of sponsored project activities, including campus, school and department sponsored project administrators, Principal Investigators (PIs), and other research personnel are required to take this training on an annual basis.

Background

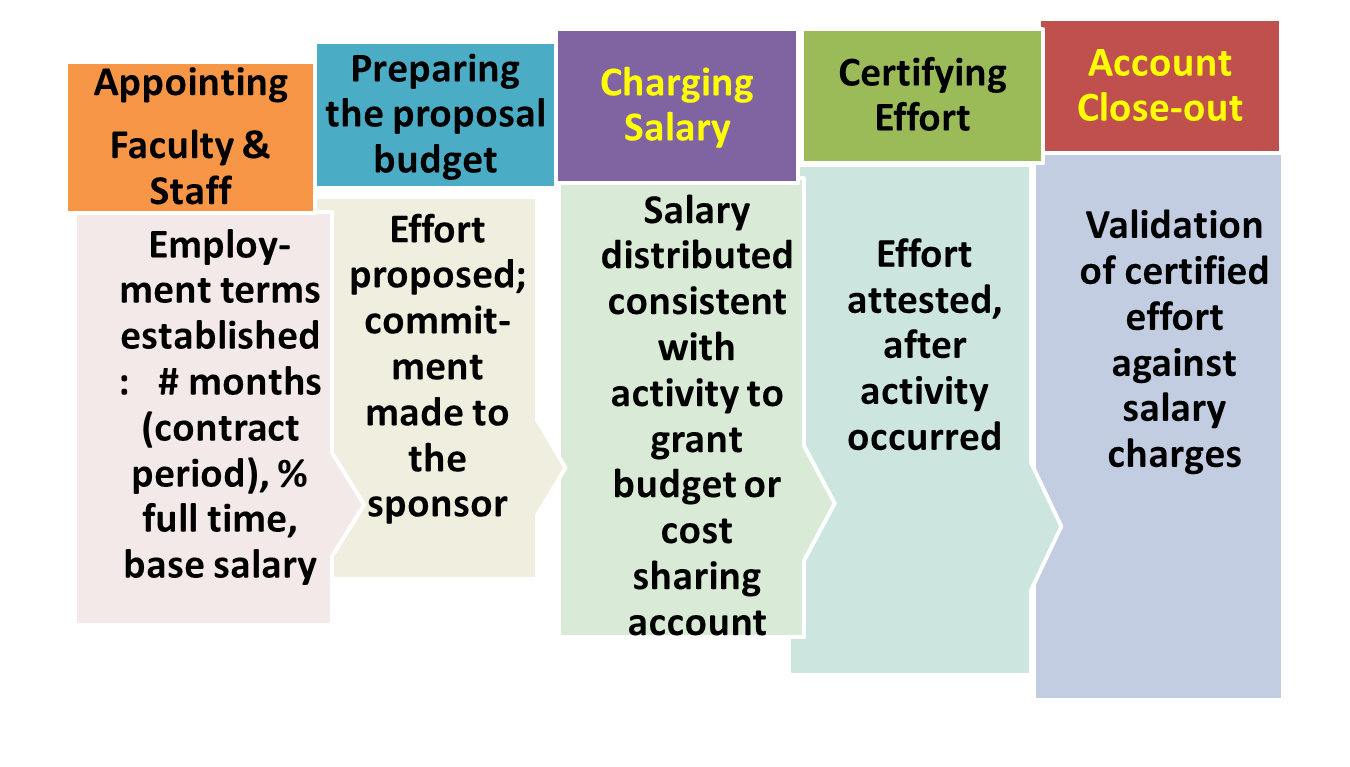

Time and Effort Certification (Effort Reporting) encompasses many processes, including committing effort, charging and cost sharing salary expenses for effort, and certifying effort to support commitments and salary charges.

As a recipient of federal funds, LSUHSC-NO must assure Federal funding agencies that the assignment of time and associated salary are appropriately expended to sponsored agreement(s). These expenditures must be fair, timely, and consistent with the effort expended on the sponsored project.

LSUHSC-NO uses After-the-Fact Effort Reporting as the means to fulfill the reporting requirement stated in 2 CFR 220 (formerly OMB Circular A-21, J10).

What is a Sponsored Project?

Any activity performed by LSUHSC-NO personnel whose associated costs are allocated to an external entity including but not limited to:

- Federal and/or State governments

- Private foundations

- Private corporations

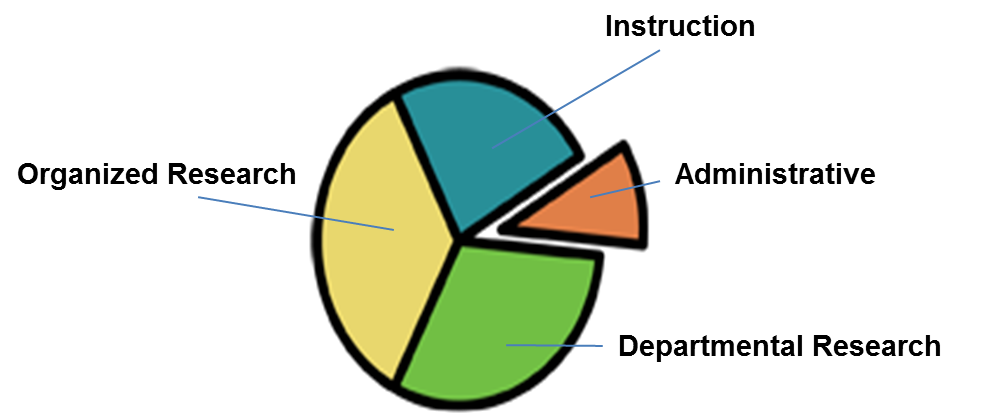

(Click or tap image for expanded view)

Effort Is . . .

- the total time an individual spends on all activities that fulfill their duties to the University.

- each activity occupies a portion of an individual’s total time spent on that activity and is expressed as a percentage of total time.

- the sum of the percentages of all the activities must always total 100% (regardless of the actual hours worked).

- should be reasonable in relation to the work actually performed.

How is Effort Determined?

An employee’s total Effort percent can never be greater than 100% or less than 100%, regardless of the number of hours or FTE’s worked. Some Examples:

- 80 hours a week = 100% Effort

- 60 hours a week = 100% Effort

- 40 hours a week = 100% Effort

- 35 hours a week = 100% Effort

It includes all Effort expended to meet commitments as a member of LSUHSC-NO’s workforce (the number of hours worked a week will vary from person to person!)

Why is Time and Effort Certification Required?

Federal regulations require time and effort certification when any part of an individual’s salary is:

- Charged directly to a federal award.

- Charged to multiple federal awards.

- Charged to any combination of a federal award and other federal, state or local fund sources.

- Used as a required match for a federal program (even though not charged to a federal program).

The certification must demonstrate that the employee worked on that specific federal program and/or cost objective in proportion to the amount compensated.

The Difference Between Effort Certification and Payroll Distribution

Payroll distributions and effort certifications are not the same thing.

- Payroll distributions are the expected allocation of an individual's salary to the various activities the individual performs to fulfill her/his duties to the University.

- Effort certification is the retrospective confirmation that the allocation of an individual's actual time and effort spent for specific activities is correct, whether or not reimbursed by a sponsor.

Effort is not just a rubber stamp of the salary or payroll distribution. Each time an effort certification form is filled out, it must be carefully examined and any substantive errors reported to the department for correction in a timely fashion (within 45 calendar days).

The time and effort certification form is merely one opportunity to make corrections. Anytime there is a substantive variance in the effort allocated to an activity, it should be reported to the department for adjustment.

What Does Effort Certification Verify?

- That salary charges are justified based on academic appointment(s).

- That effort commitments and cost sharing are performed as promised.

- That the sponsored research is appropriately classified.

- That labor charges are appropriate based on the amount of work performed (paid effort).

- That salary over the cap cost is funded by non-sponsored funds (appropriate NIH salary cap utilized).

Who Needs to Certify Effort?

Any person whose personnel costs (or portion of their personnel costs) are allocated to a sponsored project must certify that the costs are reasonable in relation to the effort expended on the project.

Effort must be certified by a person who has a “first-hand knowledge” that the effort was expended as documented.

- Faculty, academic staff, and all PI’s should certify their own effort.

- Graduate students, postdocs, and non-PI classified staff members who work on a PI’s project should certify their own effort. However, the PI can certify if needed.

Effort Reporting Phases

(Click or tap image for expanded view)

Effort Certification Life Cycle

an ongoing process ...

(Click or tap image for expanded view)

Effort Certification Requirements

2 CFR 220 requires that any effort certification system:

- Must be incorporated into the official records of the institution (ex. PeopleSoft (PS) HRMS Human Resources Management System).

- Encompasses all employee activities on an integrated basis (percent of effort ex. 100%).

- Must be certified by an individual with suitable means of verification that the effort was expended.

- Must be independently evaluated to ensure the system’s effectiveness and compliance (audits).

Reliability and Reasonableness (2 CFR 220)

“…it is recognized that research, service and administration are inextricably intermingled. A precise assessment of factors that contribute to costs is not always feasible, nor is it expected. Reliance, therefore, is placed on estimates in which degree of tolerance is appropriate.”

What Counts in Your 100% Effort?

The Time and Effort Certification form provides for six categories:

- Instruction (includes sponsored training and department funded research)

- Sponsored Research

- Sponsored Clinical Trial Agreements

- Other Sponsored Agreements

- Other Institutional Activity

- Department Administration

Activities NOT Included in Your 100% Effort?

Voluntary Uncommitted cost share is faculty-donated time above that agreed to a part of an award. Some examples:

- Outside consulting

- Serving on an NIH study section or an NSF peer review panel

Meet Professor Who

Dr. Who is a faculty member at the University and has the following Active Effort commitments:

- 20% on Project A, 20% salary charged to the project

- 25% on Project B, 25% salary charged to the project

- 5% on Project C, no salary charged

- 50% Instruction

- 5% Administration

- 9% outside consulting

Is Dr. Who overcommitted?

Hover your mouse over or tap your finger on the box below to see the right answer.

(Tap on any picture to make the answer disappear.)

Add numbers 1, 2, 3, 4 & 5 from above:

- 20% Project A

- 25% Project B

- 5% Project C

- 50% Instruction

- 5% Administration

Total Effort = 105%

Rationale: Effort can not Exceed 100%. The reason number 6, “9% outside consulting” is not included in the total effort listed above is because the outside consulting costs should not be included in an individual's 100% effort.

The Time & Effort Certification Process

- The Sponsored projects department emails the time and effort certification form(s) to the appropriate personnel (business managers) in each department.

- Every three months for classified personnel.

- Every six months for faculty and unclassified personnel.

- The appropriate personnel in each area must review and certify to the accuracy of the time and effort and make the necessary adjustments/payroll redistribution(s) within 45 calendar days.

Verifying Time & Effort

Review the Form(s) and ask yourself the following questions:

- Are the activities listed correctly?

- Are all activities performed during the period listed?

- Are any activities not performed during the period listed?

- Did any changes occur during the reporting period? (e.g. new grant beginning, contract expiring, etc.)

- Is the portion of the effort allocated to each activity correct?

- Is the portion of the effort allocated to Cost Sharing correct?

- The totals column should represent a reasonable estimate of the work performed during the specified reporting period.

At LSUHSC-NO, a variation in allocation versus actual effort of less than 5% (<5%) is acceptable.

For example, a time & effort report indicates an employee worked 75% on instructional activities and 25% on a grant. The actual time the employee worked on instructional activities was 78% and 22% was spent on the grant. The difference is 3% so a RETRO (adjustment) IS NOT needed.

Variations of 5% and more (=>5%) need to be adjusted on the Time & Effort certification form.

For example, a time and effort report indicates an employee worked 75% on instructional activities and 25% on a grant. The actual time the employee worked on instructional activities was 50% and 50% on a grant. An effort adjustment (a RETRO) IS needed and related payroll or cost share corrections must be initiated.

- For faculty or unclassified personnel, use the Per 3 for employees who work on salary.

- For classified personnel, use the Per 3 for employees who are paid hourly.

The Effort Certification Process

- Confirming Effort is the process of verifying that salary (payroll) charged to the Sponsored Project(s) does not exceed actual effort expended for any Effort reporting period.

- In some cases, these percentages of effort may not reflect the individual's actual effort to the project attributable to the initial allocation. Since the percentages are generated from the appointment data within the PeopleSoft (PS) Human Resources Management System (HRMS) payroll system, they are after the fact levels of effort the individual was expected to expend.

- If this percentage paid does not substantially (5% and more) correspond to the effort actually expended by the individual on those projects during the report period, the information on the original Time and Effort Certification form should be struck through, corrected and initialed. A payroll reallocation must be generated (PER-3) to change the actual payroll distribution in the HRMS system to match the actual effort reported on the Time and Effort Certification form.

- In the rare cases, when the actual percentages of effort expended do not correspond to those percentages previously certified on the Time and Effort Certification form, a retroactive change in source of funds and recertification of the Time and Effort form are required.

What is Cost Sharing?

Cost sharing is the University's financial contribution toward a sponsored project.

- It includes expenses related to a project that are paid by the University rather than the sponsor

- All proposed commitments must be formally tracked

For the purposes of effort reporting, cost sharing is in the form of salary contributed to a sponsored project.

Cost sharing may also be called:

- In-Kind

- Donated

- Matching

- Voluntary

- Contributed

There are three basic types of Cost Sharing:

- Mandatory - Required by the sponsor's terms and conditions and must be documented and tracked.

- Voluntary Committed - Proposed by the University and must be documented and tracked.

- Voluntary Uncommitted - Not proposed and does not have to be documented or tracked.

Cost Transfers

Cost transfers are any adjustments required as a result of the review and verification of the time and effort certification form will require a cost transfer.

Cost transfers must be performed in accordance with the University’s Cost Transfer Policy which applies to all federal, state and private awards.

Cost Transfer Requirements

The cost must be proper and allowable to the grant.

A Cost Transfer form must be filled out.

- The transfer must be supported by documentation that contains an explanation and justification of the transfer and a certification by the Principal Investigator.

- All questions on the cost transfer form must be answered.

- The “Explanation of Requested Cost Transfer” section should include a brief summary of the retro/JE.

A revised time and effort certification form if it relates to labor in previous certified time period(s).

In order to review the cost transfer request, the following items must be attached to the Cost Transfer Form when routing:

- Ledger (Nvision Report) highlighting the expenditure(s)

- Attach the per-3 or a copy of the journal entry if applicable

- A copy of the revised Time and Effort form(s) if applicable

Unallowable Cost Transfers

Transfer requests to Sponsored Projects’ awards within 60 days of an award’s end date. (The cost transfer request has to be in Sponsored Projects’ office at least 61 days before the award’s end date.)

A cost transfer from one sponsored project to another will not be processed in the following instances:

- to cover cost overruns with funds in other sponsored projects

- to avoid restrictions imposed by the Sponsor

- for other reasons of convenience.

- the justification does not adequately support the transfer being requested

- to “use up” unspent funds from a federally sponsored grant or contract

- An explanation which merely states that the transfer was made "to correct-error" or "to transfer to correct project" is not sufficient. The cost transfer should not be based on the proposal submitted to the agency.

Failing to Comply with University Policies Can Be Very Costly

While sponsored projects, especially federally sponsored projects may not account for a significant portion of the University’s revenue. Failure to appropriately manage these projects and their associated costs can create significant legal and financial exposure for the University out of proportion to the dollar amounts involved.

In 2007, Yale University agreed to pay $7.6 million related to inappropriate charges of summer salaries.

In 2004 Johns Hopkins University agreed to pay $2.6 million for overstating faculty time and effort on federal grants.

Also in 2004, Harvard University agreed to pay $2.4 million for billing the government for salaries and expenses unrelated to federal grants.

In 2006, the University of Pennsylvania agreed to pay $3.3 million related to the timeliness of cost transfers.

In 2004,Florida International University (FIU) has agreed to pay $11.5 million to settle allegations that it mischarged costs and overbilled under several contracts and grants with the Department of Energy.

Key Points to Remember

- Be Aware and try to avoid the Red Flags “Areas” (Audit Findings) listed below as they relate to time and effort certification.

- Late effort certification (> 45 days)

- Effort certified by someone without suitable means of verification.

- A distribution of effort that leaves too little non-sponsored time to credibly cover teaching, administrative, or other University duties

- Post-certification revisions

- Significant data inconsistency between the Effort Statement and

other documentation such as:

- Other outside forms

- Other support forms

- Leave reports

- Be careful about what we offer in a proposal.

- Be careful when making commitments at award time.

- Change commitments when needed, and document the changes.

- Fulfill requirements.

- Charge salary in a way that’s congruent with actual effort.

- Certify effort in a way that’s congruent with what actually happened.

- Do not charge a grant for time that doesn’t pertain to the grant.

- Do not charge a grant for time spent writing a proposal for a new project or a competing continuation. (Time spent on these activities must be covered by institutional funds.)

- Transfer salary charges off of a grant if the level of effort does not justify the salary charge.

- Effort Percentages must total 100%.

- 100% effort is NOT based on a 40 hour work week. It is based on each individual’s own average work week.

- Effort reporting tracks the reasonable approximation of actual activity on projects and should not simply mimic payroll budgeted amounts.

- Time and Certification forms must be signed and returned to Sponsored Projects within 45 calendar days of receipt by the PI or someone with suitable means of verifying or with actual knowledge.

- If actual effort is different than what is certified and a subsequent change in source of funds is done, a revised Time and Effort Certification must be completed.

- Know that help is available if you have any questions.

LSUHSC-NO Resources

Time and Effort

- Time and Effort Certification Policy

- Time and Effort Certification - Directions

- Time and Effort Certification - Quick Guide

- Blank Time and Effort Certification form

Other Related Polices and Procedures

Important Forms

- Cost Transfer form

- Per 3 (Student Workers, House Officers, POA, Supplements)

- Per 3 (Hourly - Full-time Classified)

- Per 3 (Salary) - Instructions to Per 3 Retroactive

Changes in Sources of Funds

Any Questions?

Contact the Sponsored Projects Office

Box 612

433 Bolivar St.

6th Floor

New Orleans, LA 70112

Phone:(504)568-4867

Website